There were twelve years between the signing of the Treaty of Paris on February 1763 and the ride of Paul Revere on April 1775. Tension and anger between colonists and the empire increasingly rose to the point of no return. During the short period of 1762-1770 the causing disruption in its colonial policy. Furthermore, it found itself fighting wars in Europe, West Indies and Asia which drastically increased the cost of servicing its national debt. At the top of its agenda was the lightening of the burden on British …

Up until the attempt to collect the Stamp duty colonists had accepted minor duties on trade such as the , and even the . cost more to administer than it collected in revenue. Those measures were not considered as “tax” by the colonial assemblies but as trade regulations that compensated for protection, access to foreign products and a foreign market for American goods.

Colonists were careful to draw distinction between internal and external taxes. Internal taxes were those imposed by the provincial government, members of which were elected by residents, …

It was known as the in America and titled American Revenue Act by Britih Parliament.

The Sugar Act was passed by Parliament on April 5, 1764.

It was introduced by Prime Minister George Grenville as a permanent act.

The Sugar Act replaced the that was about to expire.

The Act consists of 47 clauses that stipulate rates and duties, restrictions on trade, requirements for shippers, penalties and provisions for prosecution.

Its purpose was to undermine illegal trade and raise revenue to pay for debt incurred during the French Indian War and to pay for …

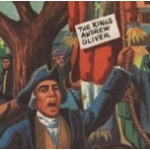

Proponents of an American Stamp Duty were found on both sides of the Atlantic but most supporters were in Britain. One of the most vocal British opponents on the American tax was William Pitt, the Earl of Chatham, who led Britain to victory during the French Indian War. Edmund Burke, a statesman and philosopher, strongly opposed the tax and supported American independence. Most merchants also opposed taxation.

British expenditure during the French Indian War almost doubled Britain’s debt. During that period the government borrowed heavily, about four-fifth of the total amount …

Representatives from nine colonies attended the Stamp Act Congress.

From Massachusetts: James Otis, Samuel Adams, Oliver Partridge and Timothy Ruggles.

From Rhode Island: Henry Ward and Metcalf Bowler

From Connecticut: William Johnson, Eliphalet Dyer and David Rowland.

From New York: Phillip Livingston, William Bayard, John Cruger, Robert Livingston and Leonard Lispinard.

From Pennsylvania: John Morton, George Bryan and John Dickinson.

From New Jersey: Hendrick Fisher, Robert Ogden and Joseph Gordon.

From Delaware: Caesar Rodney and Thomas McKean.

From Maryland: Edward Tilghman, Thomas Ringgold and William Murdock.

From South Carolina: John Rutledge, Thomas Lynch and Christopher Gadsden.

Secretary: John Cotton

President: Timothy …